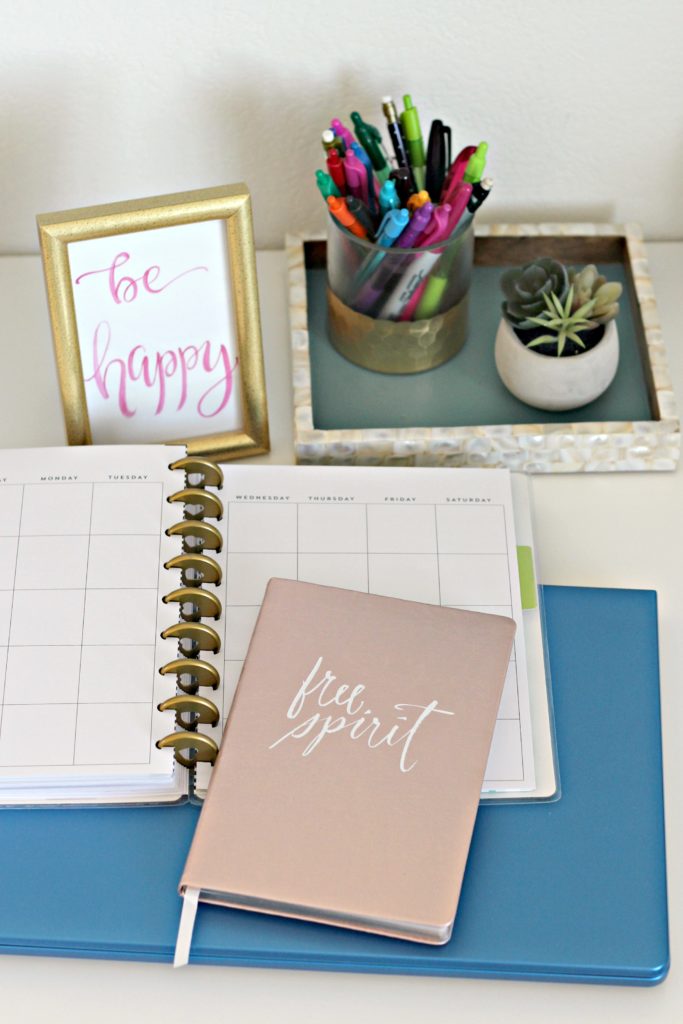

Financial Goals for Beginners to help you achieve financial stability.

At the beginning of a new year I always start thinking about what I can do to improve my financial situation. This isn’t the only time I think about setting goals and trying to better myself but it does feel like a clean slate and a good place to start. While I’m not an expert on finances I do know what has and has not worked for my family. Let’s call this post Financial Goals for Beginners, so I can share some of the basic goals to help you get your finances in order and share what has worked for me.

Set Goals for the Year

Write down your Top 5 financial goals for the new year. Having something in writing is important especially if you are working with a partner.

What do you want to accomplish?

Short Term Goals (1-3 months)

Mid Term Goals (3-9 months)

Long Term Goals (9 months-year)

Create a Budget (and stick to it)

Write down all your debts and the balance on each.

Break it down into their monthly payments.

Record everything from housing to fast food to find where your money is really being spent.

If bills are owed quarterly, every 6 months or any other way break it down to monthly payments.

Start with the most important debt at the top and work down to the least important.

Start Saving (no matter how small)

I shared a few ways to save for Christmas in this post and these can also be used for regular saving.

Open a Savings Account with as little as $25. You can also open different saving accounts for different things to keep your money separate.

Start with as little as putting extra change in a jar if that is all you can do right now (it can add up).

Just get started!

Pay off Credit Cards

Start with one credit card and pay extra on it until it is paid off then move on to the next one.

Take the money from the paid off credit card and move it to the next, keep adding to the next card until they are all paid off.

If you have a really high interest rate on a credit card have it lowered or move it to a lower interest card.

Paying off credit cards will give you more cash in your pocket with no interest. It will also give you more money to put towards saving.

Spend Less (practice being frugal)

You don’t need to go as far as a spending freeze but be aware and make good choices.

You could try a spending freeze for a month. I’ve done it and it helps me evaluate my spending choices.

Delay gratification a bit. Take a few days or weeks to decide if you really need something.

Distinguish Wants vs Needs.

Shop around for insurance and other necessary purchases.

Shop the right time of year for things.

Avoid ATM fees by going to your financial institution or an associate ATM.

We also use a cash envelope system to help us stay on track for certain expenses. You can read about it in this cash envelope post.

Get a Month Ahead (live on last month’s income)

This may take a while but by spending less and practicing some of the ideas above you should be able to be a month ahead in a few months to a year.

This gives you a cushion of at least a month if an emergency or something else happens.

Create an Emergency Fund

Save 3-6 months for an emergency (this may take a year or 2 so don’t get discouraged).

Open a separate savings account for your emergency fund.

Invest

Once you have met your other goals you can start investing to make your money work even better for you.

I don’t have a lot of knowledge about investing but a financial institution would be happy to help you.

Give Back

I feel strongly about giving some of what I have.

Even through lean times there is always someone else in greater need.

Donate to a local charity, to your church, or find a family to help.

Set aside a couple hours for setting goals and creating a budget at the beginning of each year. I hope these tips help you work toward achieving financial stability no matter how large or small your income. I would love to hear of your progress throughout the year.

Pin it for later: Financial Goals for Beginners

You might also like these posts:

Money Jars and Teaching Kids about Finances

How to Have Money at the End of the Month

This is an incredible post! My husband and I just started our personal finance journey and setting goals was a big part of it. Thanks for the tips!